An Unbiased View of Clark Wealth Partners

Table of ContentsHow Clark Wealth Partners can Save You Time, Stress, and Money.The 3-Minute Rule for Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedAll About Clark Wealth PartnersThings about Clark Wealth PartnersClark Wealth Partners for BeginnersNot known Details About Clark Wealth Partners

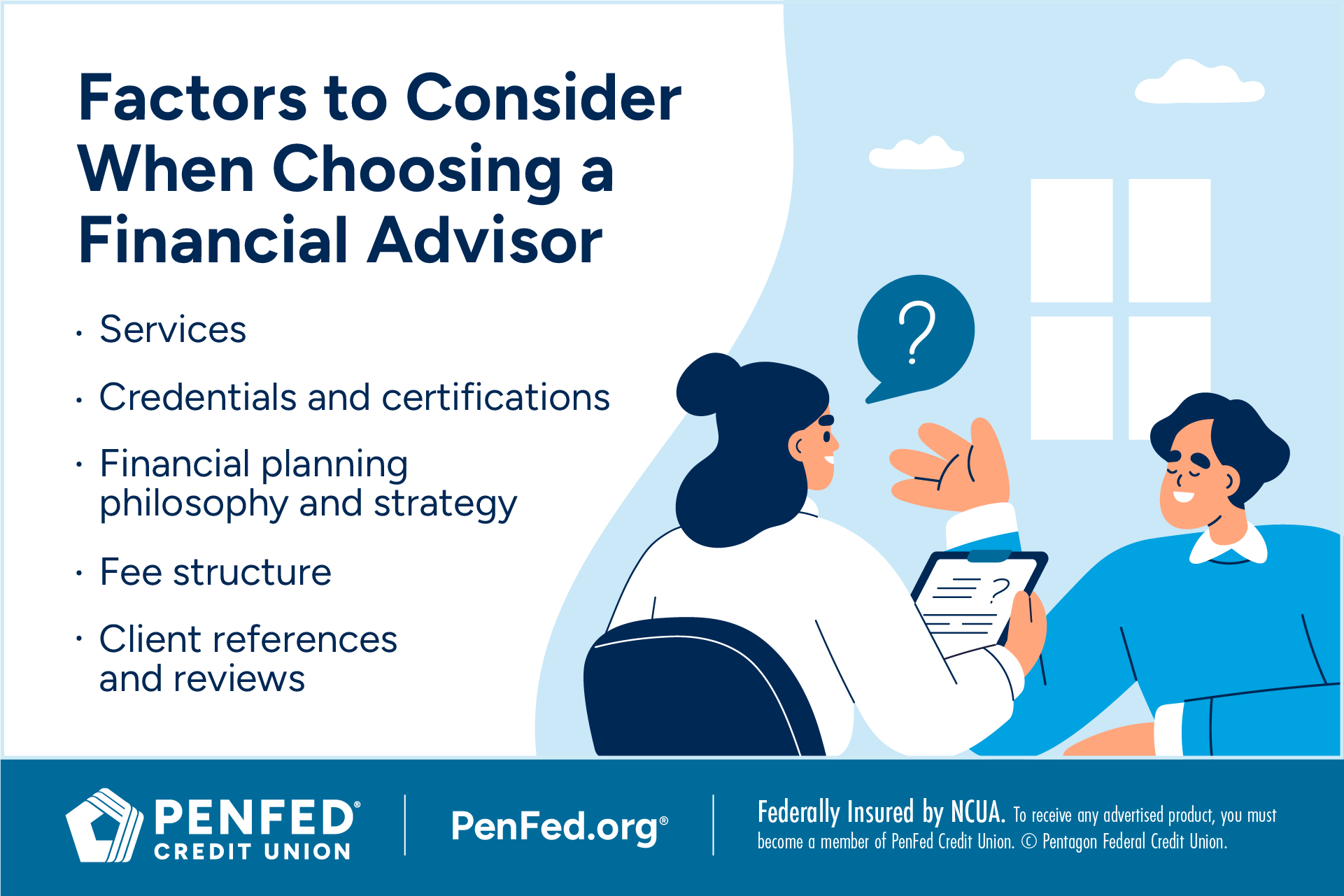

Typical factors to consider a monetary consultant are: If your monetary situation has actually ended up being much more intricate, or you lack confidence in your money-managing abilities. Saving or browsing major life occasions like marriage, divorce, kids, inheritance, or work adjustment that might dramatically impact your financial scenario. Browsing the transition from conserving for retirement to preserving riches during retired life and how to produce a solid retirement revenue plan.New modern technology has brought about more detailed automated economic tools, like robo-advisors. It's up to you to explore and identify the right fit - https://padlet.com/blancarush65/clark-wealth-partners-eb2eezozlg16amlq. Eventually, a good economic expert needs to be as mindful of your investments as they are with their very own, preventing too much costs, conserving money on tax obligations, and being as clear as feasible about your gains and losses

4 Simple Techniques For Clark Wealth Partners

Earning a commission on product suggestions does not always imply your fee-based consultant functions against your benefits. However they may be more inclined to advise products and services on which they earn a commission, which may or might not be in your benefit. A fiduciary is legitimately bound to place their customer's rate of interests.

This basic permits them to make referrals for investments and services as long as they suit their customer's goals, risk tolerance, and economic situation. On the various other hand, fiduciary advisors are legally bound to act in their client's best interest rather than their very own.

The Best Strategy To Use For Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving right into complicated financial subjects, dropping light on lesser-known financial investment avenues, and discovering means visitors can function the system to their benefit. As a personal money expert in her 20s, Tessa is acutely knowledgeable about the influences time and unpredictability have on your financial investment decisions.

It was a targeted advertisement, and it functioned. Review more Review less.

Clark Wealth Partners for Dummies

There's no solitary route to becoming one, with some people starting in financial or insurance policy, while others start in audit. A four-year level offers a solid foundation for professions in investments, budgeting, and client services.

Facts About Clark Wealth Partners Revealed

Typical instances include the FINRA Series 7 and Series 65 examinations for safety and securities, or a state-issued insurance coverage license for marketing life or health insurance policy. While qualifications might not be legally needed for all preparing functions, companies and clients usually see them as a benchmark of expertise. We take a look at optional qualifications in the next section.

Most monetary organizers have 1-3 years of experience and experience with financial items, compliance criteria, and direct customer communication. A strong academic background is important, however experience shows the capability to apply theory in real-world setups. Some programs incorporate both, Click This Link enabling you to complete coursework while gaining supervised hours via internships and practicums.

Some Known Questions About Clark Wealth Partners.

Several enter the field after operating in banking, accountancy, or insurance, and the change calls for perseverance, networking, and commonly sophisticated credentials. Very early years can bring long hours, pressure to construct a customer base, and the requirement to continuously confirm your expertise. Still, the job supplies strong long-term potential. Financial planners enjoy the chance to function closely with customers, overview crucial life decisions, and frequently accomplish flexibility in timetables or self-employment.

They invested much less time on the client-facing side of the market. Almost all monetary managers hold a bachelor's degree, and numerous have an MBA or similar graduate degree.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Optional accreditations, such as the CFP, normally require added coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Data, personal economic consultants earn a typical annual yearly salary of $102,140, with leading earners gaining over $239,000.

In other provinces, there are guidelines that need them to fulfill certain requirements to utilize the monetary advisor or economic planner titles. For financial coordinators, there are 3 usual classifications: Certified, Personal and Registered Financial Planner.

Clark Wealth Partners - Questions

Those on wage may have an incentive to advertise the services and products their employers offer. Where to locate an economic consultant will depend upon the sort of guidance you need. These institutions have staff that may help you understand and buy particular kinds of investments. Term deposits, assured financial investment certificates (GICs) and mutual funds.